The first step is to come to a decision how much involvement you’d prefer to tackle. Some internet sites supply legal forms and templates that you should fill out by yourself, coupled with action-by-stage Directions, guidance, and true-time edits to assist you together. Other companies provide to deal with the documentation by themselves.

Even though depending on meticulous research, the information we share does not constitute legal or professional assistance or forecast, and shouldn't be addressed as a result.

All of this, along with their 100% Precision Ensure, is why ZenBusiness is a standout choice for small business formation. We belief they'll help you get your online business up and functioning in no time.

A small business Company just isn't essentially a company kind—it’s an IRS tax classification. Your online business is going to be registered as both an LLC or C corp, but then it can qualify for S Corp status. Your organization could become an S Corp business enterprise as long as it’s situated in the U.S., has less than one hundred members, and—if it’s a corporation—has only one class of shares.

LLCs stand to benefit considerably from adopting a proactive stance on BOI reporting. Knowing the BOI rule for LLCs and leveraging BOI filing services can make a considerable big difference in how efficiently and properly a company satisfies its authorized obligations.

five. We provide services to mature your business. We offer ongoing compliance solutions to maintain you in fantastic standing in addition to website, accounting, and invoicing products and services to help operate and improve your enterprise effortlessly.

Tailor Brand names makes it very easy to set up an LLC for your company in any condition. The company features a straightforward on line application and expenses start from $0 for a regular LLC filing.

For LLCs, utilizing an on-line platform to file BOI stories signifies a change toward digitization, featuring a streamlined and efficient approach to compliance.

One of several 1st possibilities a business owner faces is deciding which form of company entity to open—a C Company, S Company, or LLC. In this article’s what you need to know about Each and every entity.

For additional intensive jobs and those that have to have industry investigation, including patent and copyright submitting, it’s very best to search out suppliers that realize the field and specialize in the intricacies on the matter at hand. If you’re launching a new organization, you’ll want to locate an authority who understands taxation, licensing, and state and native legislation pertaining to C and S businesses.

Entonces, si usted compra algo y luego cambia de parecer, no podemos concederle un reembolso. En el caso de clientes con Servicio de Agente Registrado, primero deberá designar un nuevo agente registrado para su empresa. Si necesita ayuda para encontrar el formulario de gobierno correcto y cambiar su agente registrado en el estado, comuníquese con nuestro equipo de Atención al Cliente.

Limited Liability Company is a lovely idea for business people, supplying some particular monetary protections from small business downturns in addition to adaptability in taxation and management. It could be taxed as a sole-proprietorship or multi-proprietorship, but In either case, business people avoid corporate tax and preserve their particular lender accounts different.

Tell us what you'd like to get in touch with your organization, and we are going to check if that title is up for grabs. (You can do this at the end if you do not have a reputation picked How Much Does an LLC Cost out still.

No podemos garantizar resultados legales específicos cuando usted usa nuestros productos o servicios. Por ejemplo, es posible que una solicitud de marca comercial se realice correctamente y aun así el gobierno la rechace por motivos ajenos a nosotros. Solo podemos reembolsar nuestro arancel por cuestiones de las que seamos directamente responsables.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Charlie Korsmo Then & Now!

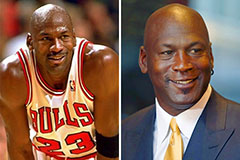

Charlie Korsmo Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now!